Bottomline: Enterprise Payment Automation & Financial Messaging Platform

Introduction

Organizations handling complex payment operations require secure infrastructure that connects treasury, banking networks, and internal ERP systems. Manual workflows can create delays, increase risk, and reduce financial visibility.

Bottomline provides enterprise-focused payment automation and financial messaging solutions designed to streamline these operations. This guide explains how Bottomline works, its core capabilities, and how businesses leverage its infrastructure.

Company Overview: Bottomline Technologies

Bottomline Technologies is a fintech provider offering digital payment and treasury automation tools. The platform supports:

- Corporate treasury management

- Digital payment processing

- Financial messaging connectivity

- Risk monitoring and compliance workflows

Bottomline serves financial institutions, corporate enterprises, healthcare systems, and public sector organizations.

Core Bottomline Capabilities

4

1. Digital Payment Automation

Bottomline helps organizations automate:

- Supplier and vendor payments

- Cross-border transfers

- Treasury disbursements

- Multi-level approval workflows

Automation reduces manual processing and improves efficiency.

2. Financial Messaging

Secure messaging functionality enables the transmission of payment files and instructions between corporate systems and banking networks.

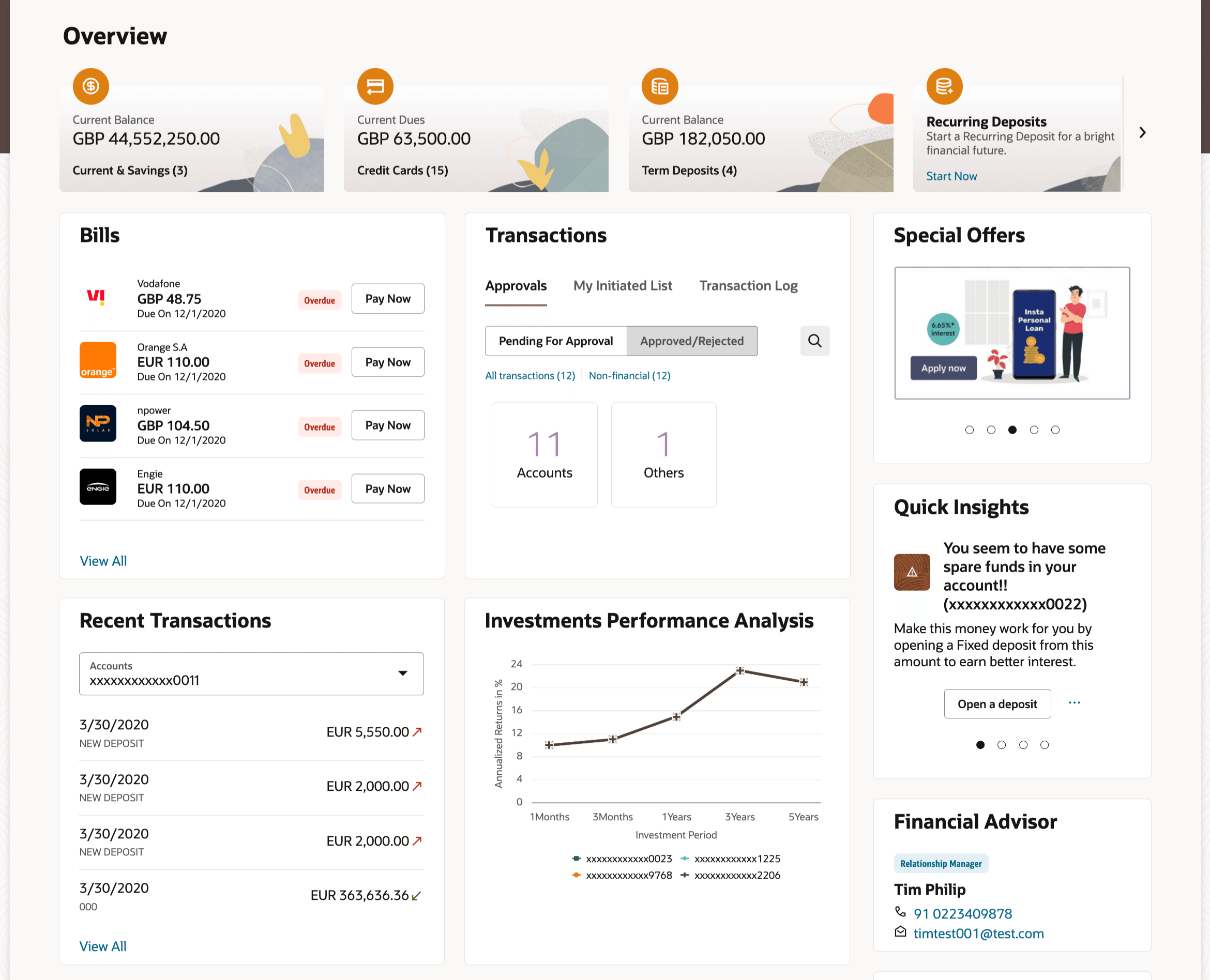

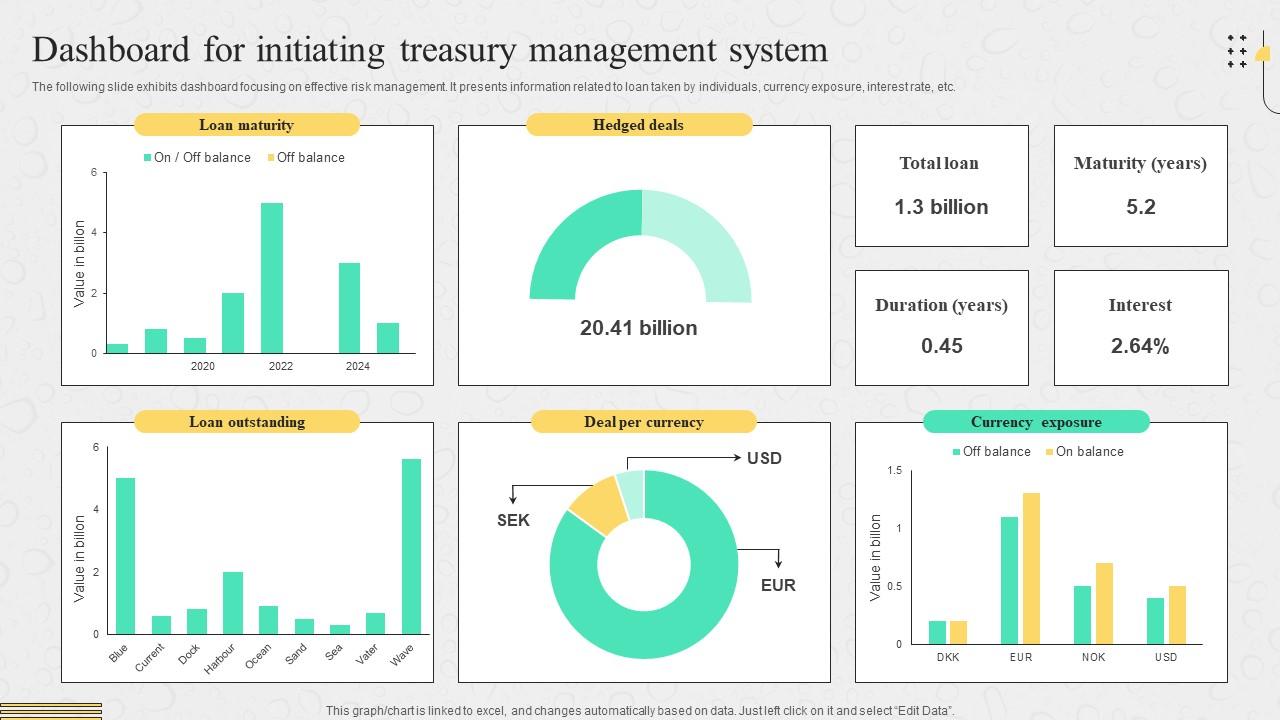

3. Treasury & Liquidity Management

Finance teams can monitor:

- Cash positioning

- Liquidity forecasts

- Payment schedules

- Reconciliation data

This centralized visibility improves decision-making.

4. Risk & Compliance Monitoring

The platform includes structured approval controls and monitoring tools to support regulatory compliance and internal governance.

How Bottomline Integrates with Enterprise Systems

Bottomline solutions are typically integrated with:

- ERP systems

- Accounting software

- Treasury management systems

- Banking networks

A standard workflow may include:

- Payment initiation within ERP

- Secure transmission through financial messaging

- Automated approval validation

- Monitoring and reporting

This structured integration reduces operational silos.

Key Platform Features

Enterprise-Grade Security

Encrypted data transmission and role-based access controls help protect financial data.

Configurable Workflow Controls

Approval hierarchies and validation rules reduce payment errors.

Reporting & Analytics

Central dashboards provide transaction insights and operational metrics.

Scalable Architecture

Bottomline supports high-volume transaction environments.

Industry Applications

4

Bottomline is commonly implemented in:

- Banking and financial services

- Corporate treasury departments

- Healthcare organizations

- Insurance companies

- Public sector institutions

Organizations managing large payment ecosystems benefit from structured automation.

Strategic Advantages

Improved Operational Efficiency

Automation reduces manual intervention and shortens payment cycles.

Enhanced Financial Visibility

Centralized dashboards improve insight into transaction activity.

Compliance Support

Built-in monitoring tools assist organizations in meeting regulatory requirements.

Risk Reduction

Configurable approval workflows strengthen internal controls.

Bottomline vs Manual Payment Workflows

| Capability | Bottomline | Manual Process |

|---|---|---|

| Payment Automation | Yes | Limited |

| Treasury Visibility | Centralized | Fragmented |

| Compliance Monitoring | Integrated | Manual |

| ERP Connectivity | Supported | Often complex |

| Workflow Controls | Configurable | Basic |

Manual processes often rely on spreadsheets and multiple banking portals, increasing complexity and risk.

Frequently Asked Questions

What is Bottomline?

Bottomline is a financial technology company offering enterprise payment automation and financial messaging solutions.

Who uses Bottomline?

Financial institutions, corporate enterprises, healthcare systems, and public sector organizations.

Does Bottomline integrate with ERP platforms?

Yes, ERP integration is a core feature.

Is Bottomline designed for enterprise environments?

Yes, the platform is built for high-volume and complex financial ecosystems.

Conclusion

Bottomline provides structured digital payment and treasury automation solutions designed for enterprise environments. By integrating financial messaging, compliance workflows, and reporting tools into one platform, Bottomline helps organizations reduce operational complexity and improve financial oversight.

For enterprises managing sophisticated payment infrastructures, Bottomline offers scalable and secure automation capabilities.