Bottomline: Digital Payment & Financial Messaging Solutions Overview

Introduction

Modern enterprises require secure, scalable infrastructure to manage payments, financial messaging, and treasury workflows. As transaction volumes increase and regulatory requirements evolve, organizations turn to specialized fintech providers for automation and operational control.

Bottomline is one such provider offering digital payment and financial messaging solutions for businesses and financial institutions. This guide explains what Bottomline does, its core capabilities, and how enterprises use the platform to streamline payment operations.

About Bottomline Technologies

Bottomline Technologies (often referred to simply as Bottomline) is a financial technology company specializing in digital payment automation, treasury solutions, and secure financial messaging.

The company serves:

- Financial institutions

- Corporations

- Insurance providers

- Public sector organizations

- Healthcare enterprises

Bottomline focuses on modernizing payment workflows while maintaining regulatory and security standards.

Core Solutions Offered by Bottomline

4

1. Digital Payment Automation

Bottomline provides tools that help organizations automate:

- Domestic and international payments

- Supplier disbursements

- Corporate treasury transfers

- Payment approvals and workflows

Automation reduces manual intervention and enhances operational efficiency.

2. Financial Messaging Solutions

The platform supports secure financial communication between institutions and corporate systems, helping organizations manage payment files and transaction instructions.

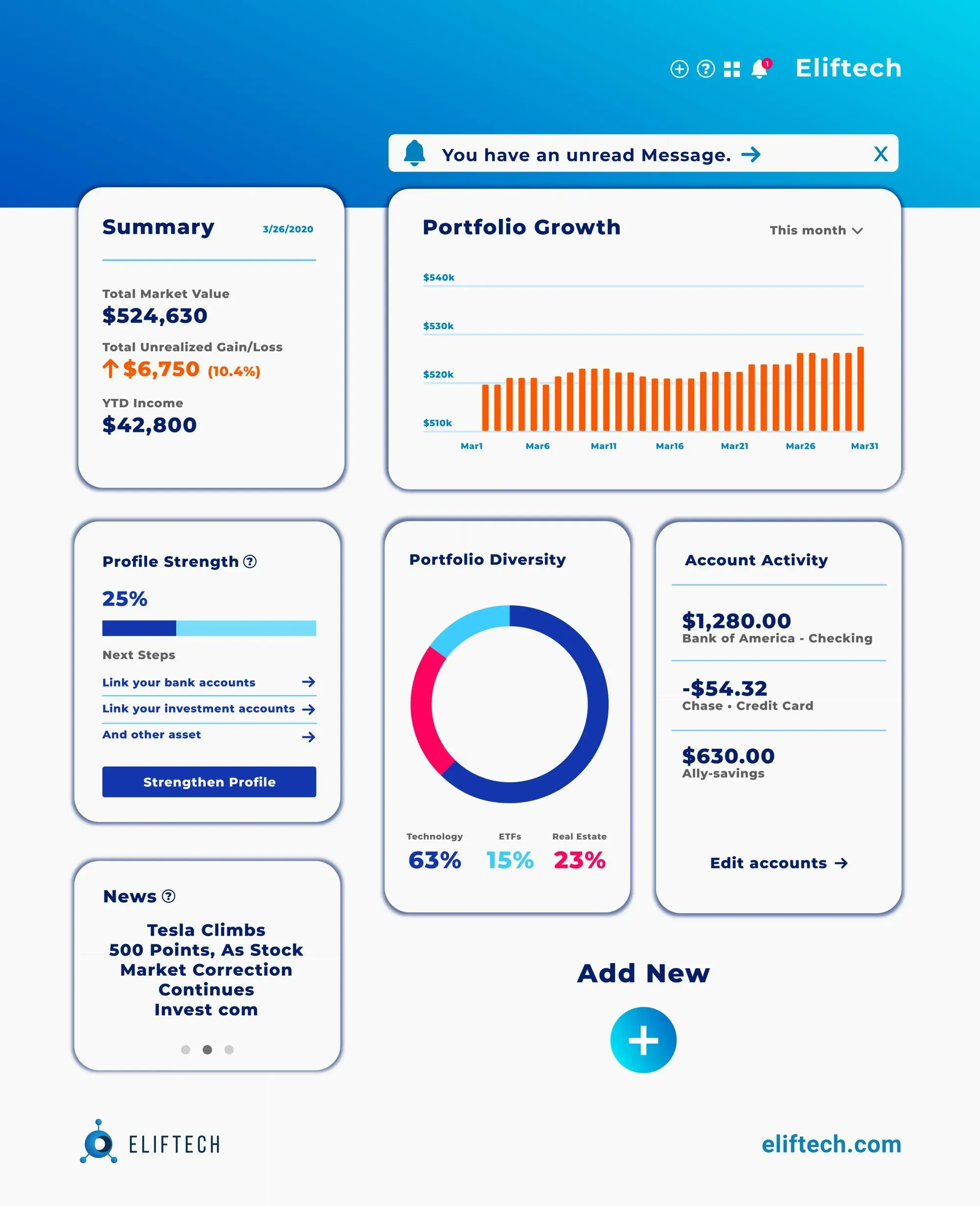

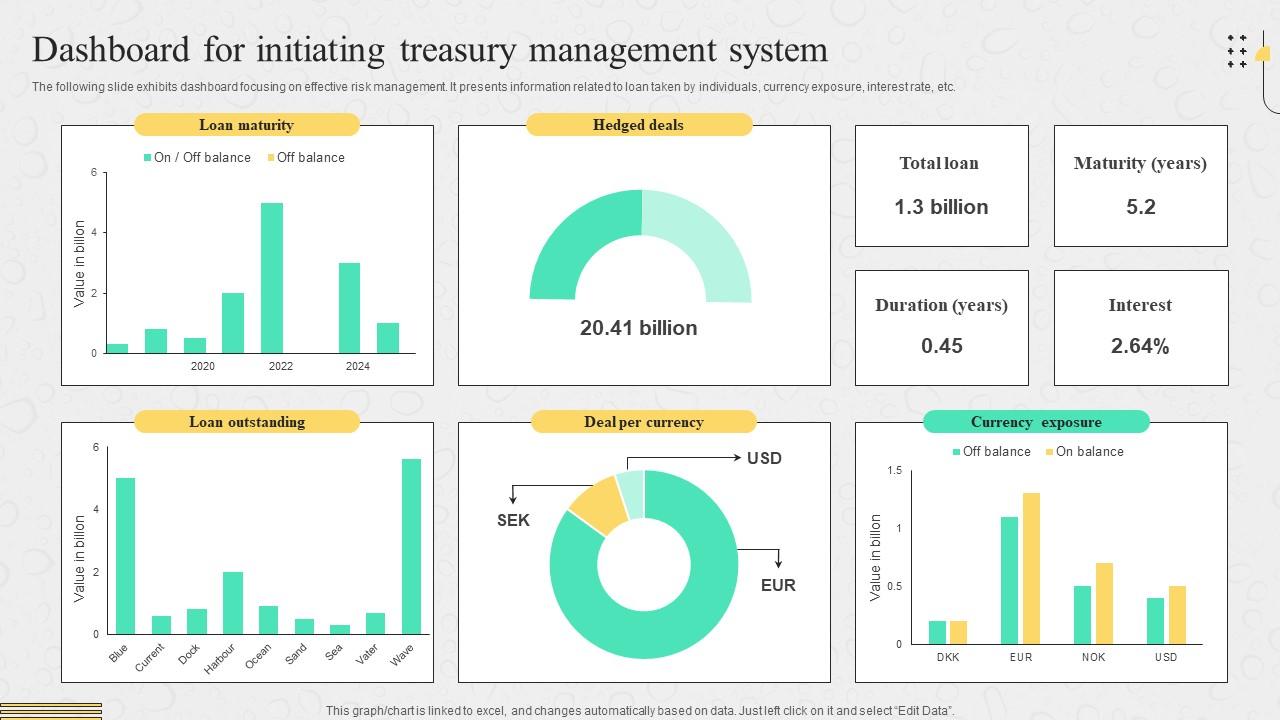

3. Treasury & Cash Management

Businesses can gain visibility into:

- Cash positioning

- Liquidity management

- Payment scheduling

- Reporting and reconciliation

This supports improved financial oversight.

4. Compliance & Security Tools

Bottomline integrates risk monitoring and compliance workflows designed to support regulatory requirements and data protection standards.

How Bottomline Works

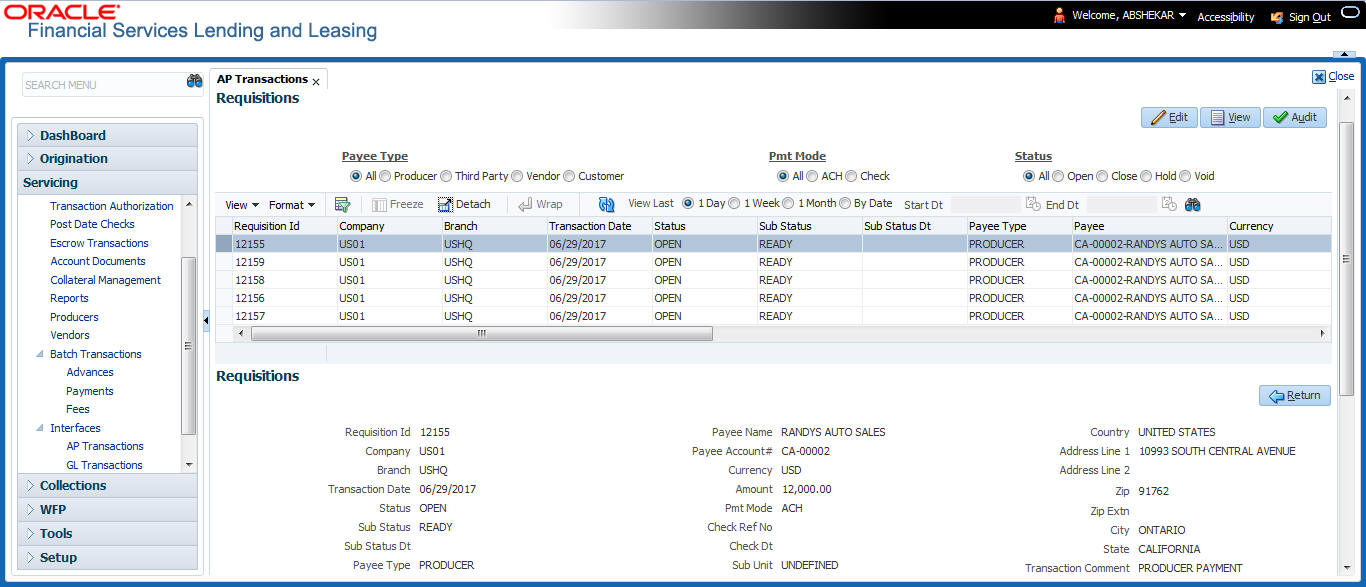

Bottomline solutions typically integrate with existing enterprise systems such as ERP platforms and accounting software. The workflow often includes:

- Payment file generation

- Secure transmission through financial messaging channels

- Automated validation and approval

- Transaction monitoring and reporting

This centralized model improves transparency and reduces operational fragmentation.

Key Features of Bottomline

Enterprise Integration

The platform integrates with corporate ERP systems and banking networks.

Payment Workflow Automation

Approval chains and validation rules can be configured to reduce manual processing errors.

Secure Infrastructure

Security measures typically include encrypted data transmission and access control management.

Reporting & Analytics

Finance teams gain access to detailed transaction reporting and performance metrics.

Industry Use Cases

4

Bottomline solutions are frequently implemented in:

- Banking and financial services

- Corporate treasury departments

- Healthcare organizations

- Public sector institutions

- Insurance companies

Enterprises managing complex payment workflows often require structured automation tools.

Strategic Benefits of Bottomline

Operational Efficiency

Automated workflows reduce manual processing and streamline payment cycles.

Improved Visibility

Centralized dashboards provide real-time insight into payment activity and liquidity positions.

Regulatory Support

Compliance monitoring tools assist organizations in meeting industry standards.

Scalable Infrastructure

Designed for enterprise environments, Bottomline supports high transaction volumes.

Bottomline vs Traditional Payment Processes

| Capability | Bottomline Platform | Manual Processes |

|---|---|---|

| Payment Automation | Yes | Limited |

| Financial Messaging | Integrated | Separate systems |

| Treasury Visibility | Centralized dashboard | Fragmented reporting |

| Compliance Monitoring | Built-in tools | Manual review |

| ERP Integration | Supported | Often complex |

Manual workflows often rely on spreadsheets and disconnected banking systems, increasing complexity and risk.

Frequently Asked Questions

What is Bottomline?

Bottomline is a financial technology company providing digital payment automation and financial messaging solutions.

Who uses Bottomline?

Financial institutions, corporations, healthcare organizations, and public sector entities use Bottomline for payment and treasury management.

Does Bottomline support enterprise integration?

Yes, the platform integrates with ERP systems and financial networks.

Is Bottomline suitable for large organizations?

Yes, the infrastructure is designed for enterprise-scale transaction management.

Conclusion

Bottomline offers digital payment automation and financial messaging solutions designed to streamline enterprise payment workflows. By integrating treasury management, compliance monitoring, and reporting tools into one platform, Bottomline helps organizations reduce operational complexity and enhance financial visibility.

For enterprises managing high-volume payment environments, structured automation and secure messaging infrastructure are essential components of modern financial operations.